What better way to start a marriage than a great conversation about taxes and finances? Right, not really, but it is extremely important to make sure you don’t miss these important check points in the process of truly “becoming one” …financially.

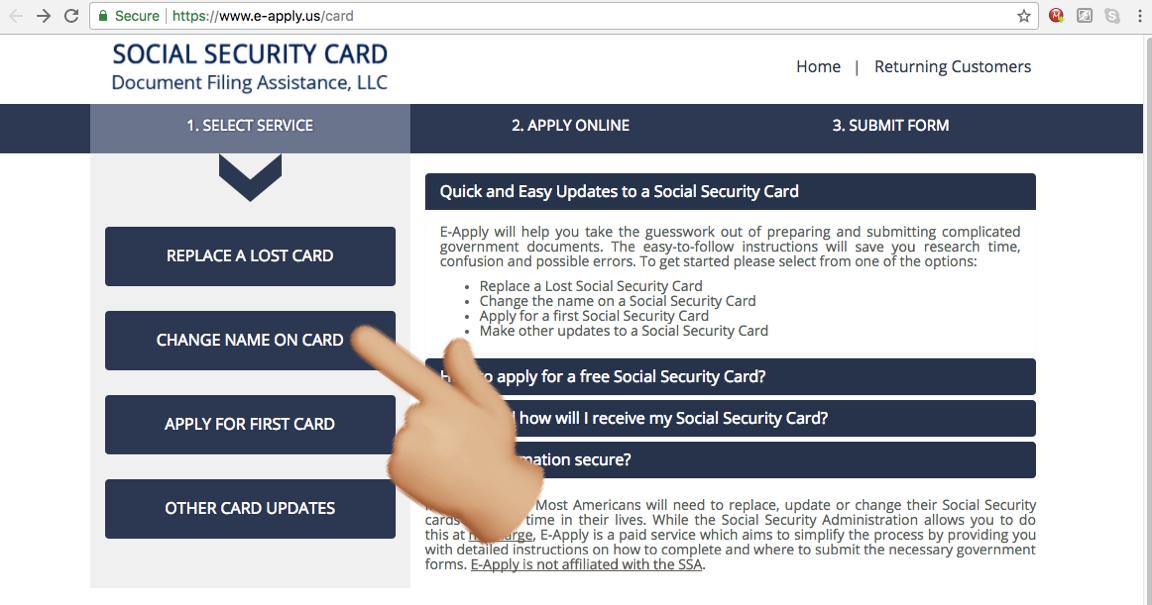

1. Ladies, did you steal his last name? Looks like you need to make a call to the Social Security Administration. If your name and your SSN do not match up when you file your next tax return it will surely cause you trouble, namely a late income tax refund. Here’s the good news: it is really simple to contact the SSA and can be done through their website or by phone call: 800-772-1213.

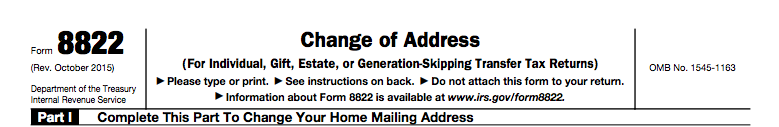

2. If you moved into a new nest together, you must complete a change of address Form 8822. You both need to fill out individual forms and send them into the IRS office nearest you. To find your nearest IRS office check out their locator.

3. While we’re here, make sure you also notify the U.S. Postal Service of a change of address so that any correspondence between you and the IRS or state tax agency goes to the correct address.

4. You will need to review your withholding and estimated tax payments to ensure you aren’t shocked with bad news at the next filing season. Let me explain: If you and your spouse work, your combined income will most likely put you in a higher tax bracket. This can cause you to lose certain tax benefits that are available to individuals in lower tax brackets, one of them being the loss or reduction of the earned income tax credit. If in the case that only one of you works, filing jointly can bring some significant benefits, one being allowing you to reduce your withholding or estimated payments. It is important to review these stipulations to ensure that you won’t be growing any extra grey hairs this year.

5. Next you will need to notify the insurance marketplace. If one or both spouses has health insurance through a government health insurance marketplace, just like the tax brackets, your combined income and change in family size could reduce the amount of premium tax credit you were once entitled to. This would require a payback of some (or all) of the credit applied in advance to reduce monthly premiums. Even further, if one or both spouses is included on their parent’s insurance policy, those insurance premiums have to be moved from their return to your return.

6. With all this talk about “filing jointly” mumbo jumbo, we should probably mention that you’re going to have change your filing status. It is important to note that no matter what point you got married in the year, you are considered married for the entire year. Filing jointly isn’t something that is outright required, but filing separately will disqualify you from many tax deductions and credits and is quite complicated if you live Arizona, California, Nevada, Idaho, Louisiana, New Mexico, Washington, Texas or Wisconsin. If you have a prenuptial agreement, this can also affect your filing status choice.

7. It is important to be aware of your spouse’s past liabilities. If you are filing jointly and your spouse owes back taxes, past state income tax liabilities, past-due child support or has unemployment debts, your share of any tax refund will be contributed to paying back these debts. If you do not want this to happen, you are entitled to request your portion of the refund back from the IRS by filing an “injured spouse” allocation form, Form 8879. You can read more about the form 8879 on the IRS’ website.

8. Something to consider if you want to file separately: each married couple is limited to $3,000 to deduct capital losses on their tax refund, but if you choose to file married separate, you are limited to $1,500 each.

9. Up next is figuring out spousal IRA. If you think you are too young to start thinking about this, or have no clue what it even is 1. Wake up!! It’s never too early to start planning for retirement and 2. Spousal IRA is a type of individual retirement account that lets the still-working spouse contribute to the non-working spouse’s retirement savings. It is the exception to the rule that someone must have earned income to contribute to an IRA. The deduction for this is limited to the smallest of 100% of the employed spouse’s compensation or $5,500 (2017) for the spousal IRA. That permits a combined annual IRA contribution limit of a certain amount (up to $11,000 for 2017). The maximum amount is $6,500 if you or your spouse is age 50 or older ($13,000 if you are both 50+). However, the deduction for contributions to both spouses’ IRAs may be further limited if either spouse is covered by an employer’s retirement plan.

10. Deductions are a big part of taxes, so naturally it must be discussed. The standard deduction in 2017 for a married couple (both spouses under age 65) is $12,700 while the single individual is $6,350. If you both have already been taking the standard deduction, then filing together will not affect you deduction-wise. BUT! If in past years one of you had enough deductions to itemize and the other took the standard deduction, after marriage and filing jointly you would either have to take the joint standard deduction or itemize, which likely will result in a loss of some amount of deductions.

11. And last but not least, we can’t forget the people that gave you away. In certain cases, filing as a married couple will impact your parent’s returns. For example, if you are being claimed as a dependent, they will lose that benefit. If you are in college and qualify for one of the education credits, those credits are only deductible on the return where your personal exemption is used. That generally means your parents will not be able to claim the education credits even if they paid the tuition. On the flip side, unless your income is too high, you will be able to claim the credit even though your parents paid the tuition.

If anything listed above is confusing or you need assistance completing any of these tasks please feel free to reach out to us, we would love to help!

Great post. I was checking continuously this blog and

I’m impressed! Very useful info specifically the ultimate section :

) I handle such info a lot. I was seeking this particular info for a very

long time. Thanks and good luck.

http://theelderscrolls5skyrimevolution225.ru